Michael Shermer, the editor of Skeptic magazine, notes that in the United States, those who are predisposed to believe in the benefits of free-market capitalism and also most likely to be skeptical of the theory of evolution.

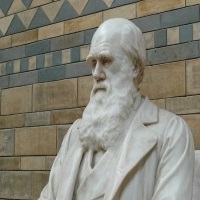

These findings are unfortunate because if anyone should embrace the theory of evolution it is conservatives. Charles Darwin’s theory of natural selection is precisely parallel to Adam Smith’s theory of the invisible hand. Darwin showed how complex design and ecological balance were unintended consequences of individual competition among organisms. Smith showed how national wealth and social harmony were unintended consequences of individual competition among people. The natural economy mirrors the artificial economy. Conservatives embrace free market capitalism. In fact, we are against excessive top-down governmental regulation of the economy because we understand that it is a complex emergent property of bottom-up design in which individuals are pursuing their own self interest without awareness of the larger consequences of their actions.

I will preface my remarks by saying that I share Shermer’s view in the benefits of capitalism and deny the effectiveness of centrally planned economies, such as existed in the former Soviet Union. Although Shermer doesn’t mention central planning as such, an excessively regulated economy can almost amount to the same level of government control. Given that, and in the interest of simplicity, I will use that most extreme example to show that top-down economic approaches are guided more by blindness, and that bottom-up economies actually do rely on substantial amounts of intelligent design, which inverts Shermer’s proposal.

The first flaw is this – even without a top-down designer, products are still intelligently designed in a capitalistic free market. No product appears out of blindness – designers work to create a product that they think people want to buy. They do not shuffle a box of parts together and hope a functional product comes out. They do not let random processes add code in order to upgrade previous versions of software. After a product is created, the firm must decide what markets and distribution channels to use to get it to the end consumers. If they just flipped coins on these things, they wouldn’t be in business very long.

Second, the real problem with a top-down economy is not necessarily that it is top-down, but because it has substantial blind spots, and is therefore less intelligent. Think of a businessman who owns a successful construction company. He only needs to know and be an expert in the economic areas that affect his business. The central planners, however, have the burden of trying to run the entire economy. They must know and anticipate customer demand for not just construction, but retail, automobile, energy, restaurants, travel and leisure, clothing, and so on. The problem with this arrangement is that knowing all of these things is far beyond the capacity of the human mind. Even a team of minds working together can’t do it. Labor and raw materials need to be allocated to all of these activities. A team of experts must come to an agreement on where these resources must go, which requires absorbing the knowledge of the other, weighing it against their knowledge and deciding on what the priorities are.

The individual businessman, however, is only trying to allocate resources to a limited and manageable number of projects. Since the scope of the business lies within his area of expertise, he can knowledgably allocate his small range of available resources to that end. Even if he doesn’t exercise a top-down authority and is limited in his power, he is still operating with more intelligence than the central planners can have.

Thirdly, Shermer is only half right in saying that there is an economics-Darwinian parallel with respect to individuals pursuing their self-interest without “awareness of the long-term consequences of their actions”. True, many business owners may not have the betterment of society in mind when they engage in commerce. But that does not mean that they succeed without any awareness of the consequences of their actions. Indeed, many are successful because of their foresight and the ability to foresee developing opportunities and how to capitalize on them. In the natural world, animal species have absolutely no way of performing any kind of activity that mirrors this process. Animals do not come together in meetings, develop long-term strategic plans and work to design new biological features that will give them an evolutionary advantage.

Fourth, central planners operate under another form of blindness, that of not having high quality information as to what resources (like labor and raw materials) are scarce and which are plentiful. In a market economy, supply and demand will drive prices and wages higher or lower, based on their availability. When a product costs too much to produce, its production will stop and scarce resources will be conserved. The central planner, on the other hand, will never know when he should stop producing, and will end up wasting scarce resources on products for which there is little demand.

Theoretically, there is a way that a centrally-planned economic system could work well. If a central planner possessed omniscience, that person would know exactly what consumers need or want and how to allocate resources available to that end. That is the analogy between economics and creation/evolution that is most appropriate, and it leads to the opposite conclusion that Shermer wanted.